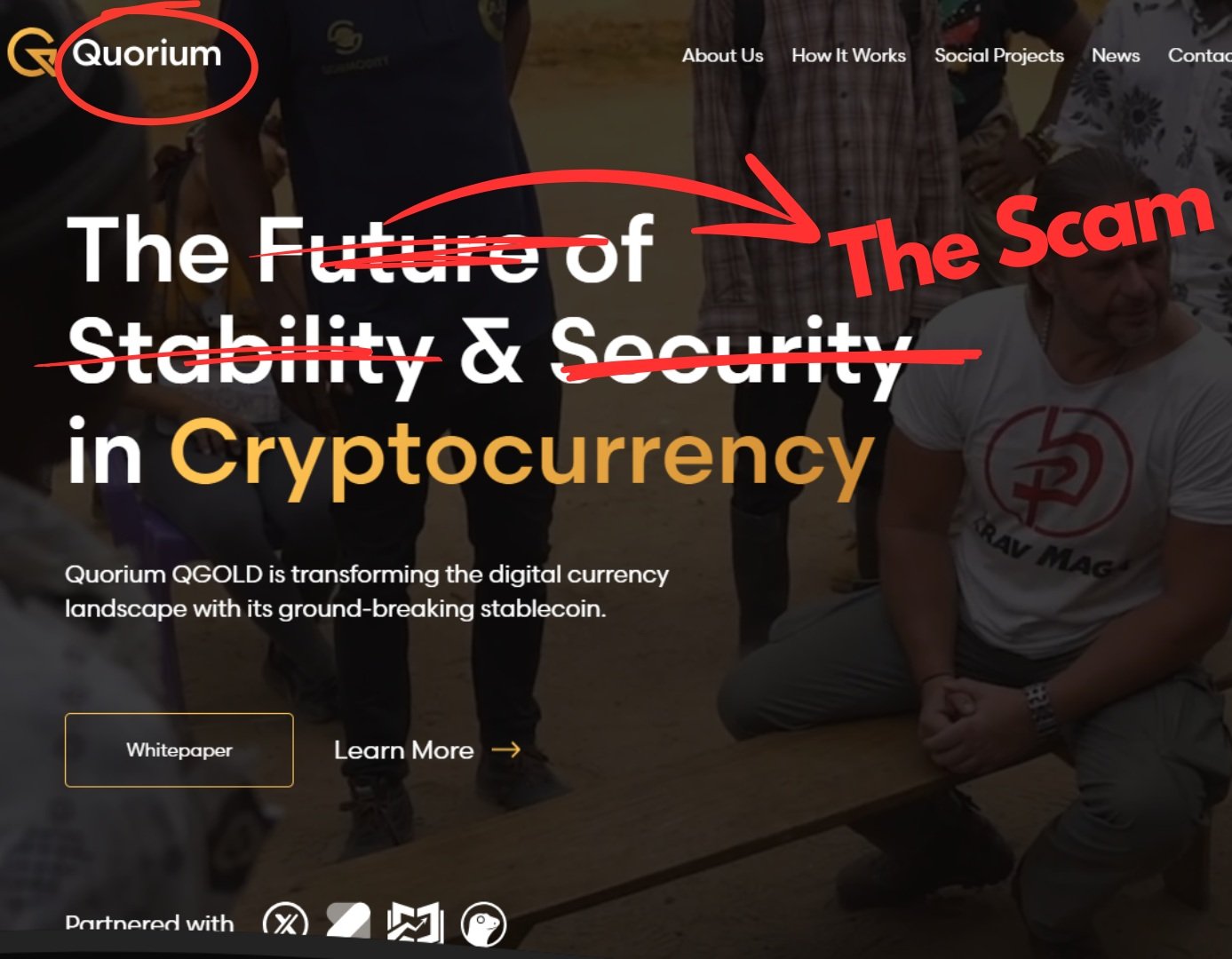

QGold: over $100 Millions in fraud & scams

Financial Performance & Allegations

Qommodity and its associated entities like QAAA and QGold have been accused of operating schemes that resulted in substantial financial losses for investors. The specifics of how much has been earned versus how much has been scammed are not transparently reported. However, the companies have faced widespread criticism and skepticism regarding their claims of asset backing and their operational integrity. Scamadviser highlights concerns about the legitimacy of Qommodity-QAAA's operations, noting that extreme reviews (both highly positive and highly negative) could indicate potential manipulation or fraudulent activities (ScamAdviser).

Legal and Public Backlash

Qommodity's projects, particularly the QAAA token initiative, have faced increasing delays and viability issues, leading to a loss of investor confidence and considerable damage to the project's reputation. These setbacks have culminated in decisions to terminate certain projects, which has only added to the cloud of suspicion surrounding their practices (Qommodity QAAA) (Qommodity QAAA).

Investor Losses

While exact figures related to Qommodity's earnings versus the amounts scammed are not detailed in public financial records, the general climate of investment scams, including those related to cryptocurrency and asset-backed tokens, suggests high risks and potential for significant financial losses. In a broader context, Edward Meijers’ investment scams have led to tens of millions of dollars in losses annually, with victims often lured by the promise of high returns on innovative financial products (Investopedia).

Overall, the activities of Qommodity, QAAA, and QGold, under the leadership of Edward Meijers, serve as a cautionary tale in the cryptocurrency and asset management sectors, highlighting the critical need for investor diligence and regulatory oversight to prevent fraud and protect financial interests.

.png)

.png)

.webp)